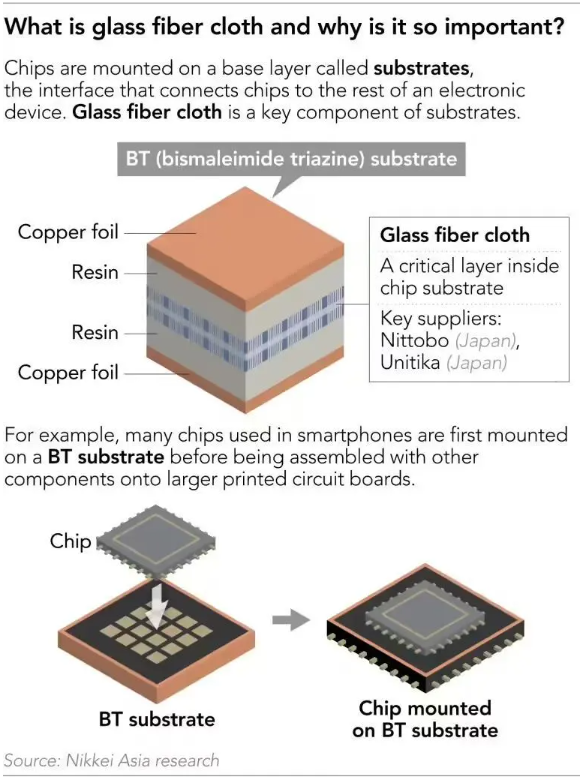

Apple's hitting a weird supply crunch right now - not with chips themselves, but with this super-specific material called "glass cloth" (or glass fiber cloth, specifically the high-end T-glass type). It's basically the hidden "skeleton" inside printed circuit boards and chip substrates - super thin fibers woven like a tough film, thinner than hair, that holds everything steady, handles signals, and doesn't warp under heat. Perfect for high-performance stuff like AI chips and flagship phone processors.

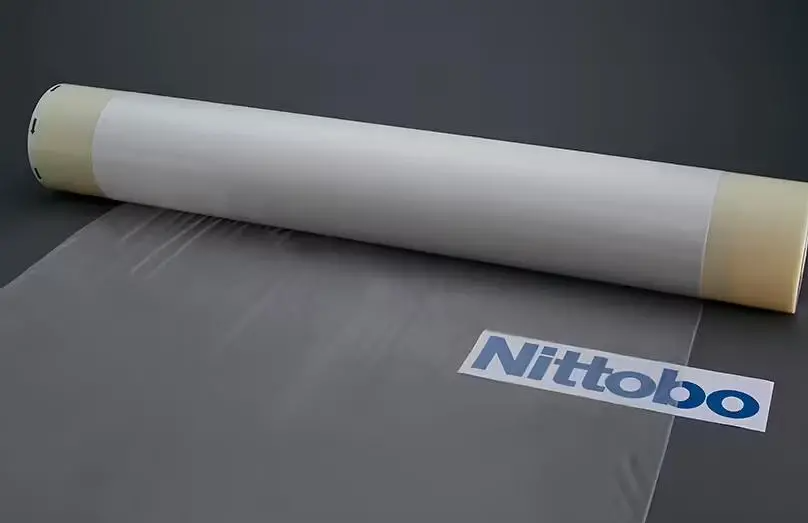

According to a Nikkei Asia report that dropped on January 14 (picked up everywhere today, January 15), the AI boom has exploded demand for these premium PCBs, and everyone's scrambling for the same limited supply. The catch? Almost all the top-tier T-glass is made by just one Japanese company: Nitto Boseki (Nittobo). They dominate because the stuff needs to be insanely precise - zero bubbles, zero defects - and that's a huge technical barrier. No one else can ramp up quickly to fill the gap.

Apple was actually an early adopter of this material for iPhone chips (way before the AI rush), which gave them an edge at first. But now Nvidia, Google, Amazon, AMD, Qualcomm, and others are piling in hard for their AI/server chips, squeezing the supply even more. Industry folks are calling this one of the biggest bottlenecks for electronics and AI gear in 2026. New capacity from Nittobo isn't expected until the second half of 2027 at the earliest - they won't rush expansion just to chase volume; quality first.

Apple's not sitting idle, though. Reports say they've taken some pretty aggressive (and unusual) steps:

- Back in fall 2025, they sent their own people to Japan to basically camp out at Mitsubishi Gas Chemical (a key downstream substrate maker that relies heavily on Nittobo's glass cloth). The goal? Watch production closely and make sure Apple's orders get priority.

- They've even reached out to Japanese government officials to try and get some official help coordinating supplies - that's how serious it is.

- On the side, Apple's looking at backup suppliers (like Taiwan's Grace Fabric Technology) and pushing partners like Mitsubishi to improve quality on alternatives. They've talked about using lower-grade glass cloth temporarily, but that needs tons of testing and validation, and it won't really fix the 2026 crunch for new iPhones (maybe iPhone 18 series?) or other products.

Qualcomm's in the same boat for their mobile chips. And while no one's saying production will completely stop, it could mean delays, higher costs, or forced compromises that ripple into device pricing or availability. Stocks for Apple and Qualcomm dipped a bit today on the news.

It's a classic case of how one obscure upstream material can bottleneck the whole chain when demand surges like this. Kinda reminds people of past shortages (DRAM, etc.), but this one's extra tricky because of the single-supplier monopoly and the ultra-high quality bar. We'll see how Apple navigates it - their supply chain team is usually pretty good at these crises, but this one's testing them hard.